Employers: Turn Payroll Costs Into Profits w $0 Copay Benefits Funded by Tax Savings

Finally, a proven, IRS-compliant tax strategy that cuts costs, boost retention, & gives employees $0-copay benefits —24/7 urgent, mental health, primary care, RXs & more at no net cost. One site for all services. Get help in 20 minutes. No claim hassles.

Whole-family, holistic prevention — the only real cure for today’s broken healthcare system.

EHP/Revive's Preventative Care Wellness Program &

Tax Strategy that PAYS EMPLOYERS

Stacks on Existing ACA-approved health plans

Requires very little HR "lift"

EHP enrolls 85-90% on average in Year One

Employer Savings - If you have 25+ W2s

$640 in FICA Tax Savings per Employee Annually

18-40% Workers' Comp Reduction (most states)

20-40% Savings on Self-Insured Health Plans

$20k-120k/Employee Retained in Turnover Costs

Employee Benefits

Spouse & up to 5 Dependents

$0 Copays for Urgent, Primary & Mental Health Care

$0 Healthy Weight Care

$0 Generic RXs Delivered

Fully Funded by Employee Tax Savings

$50-150/mo Increased Take-Home Pay (State Dependent)

-

Validated → by CPAs, attorneys, and state governments--independently reviewed & trusted.

-

Compliance → EHP/Revive’s SIMERP program is a permanent IRS-compliant solution that reduces payroll taxes & workers’ comp costs while funding more health benefits for employees.

-

IRS Supported→ properly structured, EHP/Revive's program provides less costly, preventative healthcare options for employees & their families — with better access to urgent, primary, mental, chronic care & more — helping fix a broken system.

-

Results→By diverting routine care costs "off-plan" to Revive's $0 Copay Plan, the costs of self-insured health plans to employers is reduced by 20-40% (based on ~ 85% enrollment average)

Watch the Executive Brief Video to see how EHP/Revive’s program is structured to meet IRS guidelines—while reducing costs for employers & expanding $0 benefits for employees & families.

SOLVE 4 COMMON PAIN POINTS:

Rising Healthcare / Benefit Costs

Bottom Line Profit Blead

Cash Flow Concerns

Employee Retention / Acquisition Costs Soaring

Video - Executive Brief on EHP/Revive's Program

Understand how Employers are using an IRS-compliant SIMERP program to increase employee retention and provide valuable health benefits to Employees at no cost to either — while reducing payroll costs, workers' comp premiums, and self-insured health plan costs (if applicable).

This 17-slide PDF shows how the program works step by step — from IRS compliance to paycheck impact — so you can see exactly how it’s funded and validated. (It is the same deck used in the video)

“Would you be opposed to taking 30 minutes to speak with a Tax Strategist & Benefits Expert to learn more about how EHP/REVIVE are helping thousands of employers turn today’s most difficult pain points into the following simultaneous solutions?”

Video - An Employee Paycheck Shows How EHP/Revive's Program is Funded by Tax Savings

EHP - Understanding Paycheck Impact 4-34

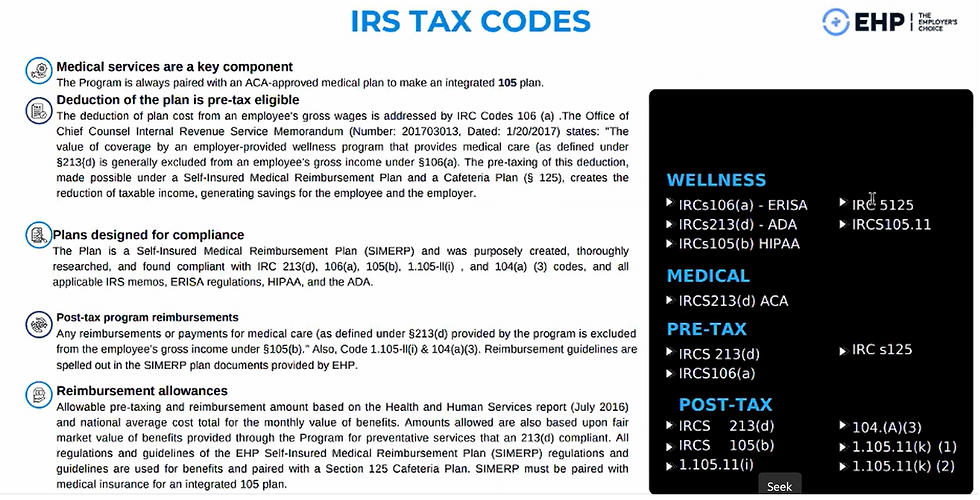

TAX CODES - The IRS Wrote the Tax Codes Supporting SIMERPs - Which the Affordable Care Act Reinforced.

EHP Provides Audit Support--has never been required.

THAT'S TRIPLE PROTECTION!

Video Below - Revive's Unrivaled Wellness Program

$0 Cost, $0 Copays for Urgent, Primary, Mental Health, and Weight Management Care. Plus, $0 RXs delivered.

Below - Click to View and Download

Video Below - CRO of Revive Discusses the Unrivaled Wellness Program - Long Form Video

Here’s what happens next when you book a call...

You will speak with a Subject Matter Expert on your Discovery Call. They will simply educate your team on the tax codes, the program itself, the process, and allow you to ask any questions you have. 60% of Discovery Calls commence with the employer preparing & submitting an Employee Census (completed in a few minutes using a QuickBooks export). The Proposal Call is typically set for 5-7 days after the cencus will be submitted.

On the Proposal Call, we will provide you with real FICA savings based on your situation, and savings for those on Self-Insured Health Plans can be discussed, as well as Workmans' Comp savings. 90% of these calls result in onboarding!

This is a quick, high conversion process. Your team sets & attends 2 inital calls, and upon your decision to move forward EHP takes care of >90% of the heavy lifting from program coding set up, to education through enrollment. EHP will continue to drive enrollment, with a goal of hitting 90% participation by the end of year one. Our success depends on yours & your employees, so we remain engaged the entire time.